What We Do For Companies

We provide an efficient platform for privately held and unlisted businesses who are seeking a liquidity solution for holders of their securities.

Regularly updated securities pricing makes for more accurate mark-to-market valuations, allowing your investors to crystallise tax benefits and providing issuers with verifiable and up-to-date information for banks, suppliers and clients alike.

And with institutional demand for investing into the unlisted asset class continuing to grow, this provides a streamlined route for prospective corporate investors to not only compare the options available to them but also execute the necessary transactions when the time is right.

For companies seeking to raise capital for the first time, we also offer an assisted financing service. Using our network of brokers and placing agents, we can introduce the right-sized partner to meet the exact needs of the issuer, reflecting their size, sector and stage in terms of business development.

Why We Do It

The market in the UK is fragmented and underserved when it comes to meeting the financing and liquidity needs of privately held companies. The JP Jenkins approach allows business owners to leverage the value they have created, matching buyers and sellers across a wide range of investment opportunities. And with a growing number of unlisted assets that investors actively want to trade or value, the market is desperately in need of innovative, transparent and accessible solutions such as ours.

How We Do It

JP Jenkins is a match-bargain facility that acts as an arranger agent to connect willing buyers and sellers of unlisted securities. Using InfinitX technology, we provide a seamless, market-like experience where authorised brokers and financial institutions place expressions of interest (EOIs) over existing market infrastructure.

We facilitate matching these EOIs and coordinate settlements through our dedicated settlement agent. By working exclusively with regulated brokers, we enable access to liquidity for unlisted securities, offering efficient entry and exit opportunities at a fraction of the cost of traditional stock exchanges.

For companies raising capital, we provide an assisted financing service, introducing issuers to brokers and placing agents best suited to their size, sector, and growth stage.

Our Companies

JP Jenkins works by matching a willing buyer with a willing seller through 40+ connected regulated brokers.

It provides a low cost and efficient venue for unlisted / private companies to allow shareholders and future investors to buy and sell their shares.

ACCESS TO EQS

A primary information provider which distributes regulatory type announcements to market data systems including Reuters, Dow Jones and Bloomberg.

EVENTS AND NETWORKING

Regular events programme offering networking and meetups between similar companies, lawyers, advisors, investors and technology providers.

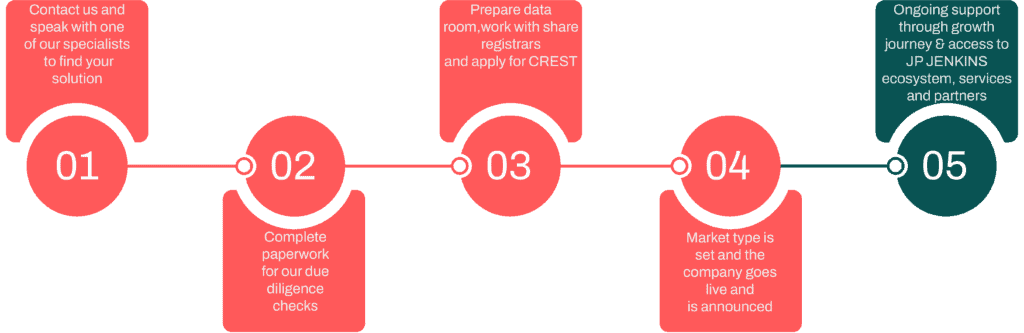

A 5-STEP Onboarding Process

We have a target of getting issuers live on the JP Jenkins platform within six weeks of first contact.

The following staged process will be used:

Using the latest technology

By using new, innovative technology from InfinitX, we can display live, real-time pricing with any registered broker or other financial institution. They can then connect, execute and settle with JP Jenkins over existing market infrastructures. Check with your broker regarding access and suitability

POWERED BY